I thought I’d never say this but a tip of the hat to the Feds for putting the squeeze on Comcast’s proposed buyout of Time Warner Cable…

I thought I’d never say this but a tip of the hat to the Feds for putting the squeeze on Comcast’s proposed buyout of Time Warner Cable…

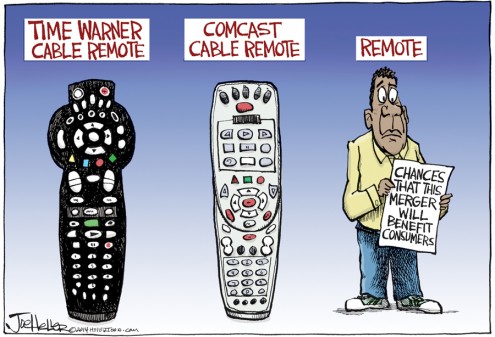

A merger that was good for consumers?

If you believe that then just look at what these type of mergers have done in other industries.

Take the airlines where Delta gobbled up Northwest. United acquired Continental. USAirways took American (but kept the AA name.) And Southwest landed AirTran.

Has the public benefited?

Of course not. In most cases the opposite has been the case.

Competing routes between many cities have been combined. WHowever, where once you may have had eight daily non-stops between city A and city B, you now have maybe five after the merger.

Which of course makes for fewer available seats between the two cities and—you guessed it—most likely higher fares per seat since they’re now stuffing more people into fewer flights.

That’s also the case in the cable television business where Comcast leads the flock.

That’s also the case in the cable television business where Comcast leads the flock.

Had the FCC and FTC not pressured Comcast into giving up on their hard fought attempt to acquire TWC, your monthly cable bill surely could have skyrocketed.

And service? What service?

Comcast doesn’t exactly have the purest reputation along the service lines.

Here in the KC metro where TWC leads in subscribers, Comcast is also a player in various suburban communities.

Together as one they could have really put the squeeze on everyone AND their competition.

Comcast is big, they’re No. 1 in cable.

They’re NBC, Universal Pictures and more. But now that they’ve felt the pressure of Uncle Sam coming down on them, they will have to make do with what they already have with their cable operations.

That after spending millions of dollars lobbying for the deal…….

Sure, I’ve heard all the arguments in favor of a Comcast-TWC deal.

But look at how these mergers have worked in other media related businesses. Multiple TV station ownership in large markets. Radio groups dominating major cities. No thanks.

Whatever the Feds did to keep wireless phone service and major market cable tv competitive seems just about right to me.

Glad I have Gooble Fiber and don’t give a rat’s ass about the cable companies anymore. I pay $100 less per month, and get all the tv I want & need, plus unmatched internet speeds. Piss on the cable/satellite providers. They are huge ripoffs.

Just remember that even Google has to pay program providers for content. Most expensive on a per subscriber basis I believe is Walt Disney’s ESPN.

And you just know that as these program provider costs spiral, these increases will be passed on to us—even to Google subscribers……

Yes, but it’s all relative. The provider costs will increase for the cable/satellite companies as well. That being said, the way people are watching tv is changing drastically. If Netflix continues to improve it’s product and content…..watch out.

I assume you enjoy living in the past. The cable companies are dinosaurs and the Feds are essentially determining who can continue using vacuum tubes as opposed to the newest technology.

We are very close to having Google, Apple, NetFlix, Amazon, cell phone companies and any wifi enabled application provide content when and where we want it.

Enjoy your $150 bundled package from your government approved cable provider. I will take my programs on demand and pay for only the content I want.

+1

Biggest lies

1.Consolidation is good for consumers

2. I am from the IRS, and I am here to help you

3. I have a great deal for land in Florida

4. Al Gore..”I created the internet”

5. Harley “knows all”

Please, Oh Please, buy Fairpoint. I’d like to welcome you to mergers and acquisitions, the place where we put two companies together, decide that the work can be handled by less workers and proceed to cut about 1/4 of the staff. Of course, we hope that the staff can be more efficient and deal with twice as many customers with 3/4 of the staff, all for the benefit of the shareholder, I mean customer. Generally, the Sherman and Clayton antitrust laws should have been able to deal with it, finding treble damages for companies that approach a monopoly or even oligopoly, but enforcement is rare. Today, we just ask Commerce, Justice, Labor, OSHA, the EPA, Congress, the President, and news media for comment before allowing a merger, and the authorities, many who have nothing more than a grade school economics education to make the determination whether they should be joined together or forever hold their peace. The problem is that economics is not taught in grade school. The second problem is that utility governance was originally a state managed affair with public utility commissions, Departments of Health and Education, all have been outgunned and out maneuvered by global utilities. So from the scholarships awarded to the children of the Missouri PUC for a favorable opinion about a power plant in Peculiar, Missouri, to the sales of public domain by Montana Power in an attempt to become an internet service provider, the road is pockmarked full of decisions made on a personal level. In terms of phone service, AT&T (actually Southwestern Bell) has proven that there is nothing the government has split up that can’t be put back together. Now, about Fairpoint, my home phone service, born out of sending the management of Casstel to a lovely gated location, where room and board are provided free, all because management had the audacity to obtain and spend rural subsidies offered by the federal government, for a rural population they claimed was larger than the state of Kansas. So what is a regulating body to do? They sold it to Fairpoint, a phone company from the east coast that within a few months posted a Q on their stock symbol. (This means they have filed for protection from creditors). Thank you. My argument is that I know that the companies are bad, but perhaps the regulators may be worse. I just want some of the utilities, monopolies by definition, to lose their anti-trust protection. The penalty of three time the rate increase might just be enough to consider the customers above the shareholders.